TransFICC is recognised as one of The Most Influential FinTechs of 2024

We are on Harrington Starr's List of the Most Influential FinTechs for 2024

Read More

We are on Harrington Starr's List of the Most Influential FinTechs for 2024

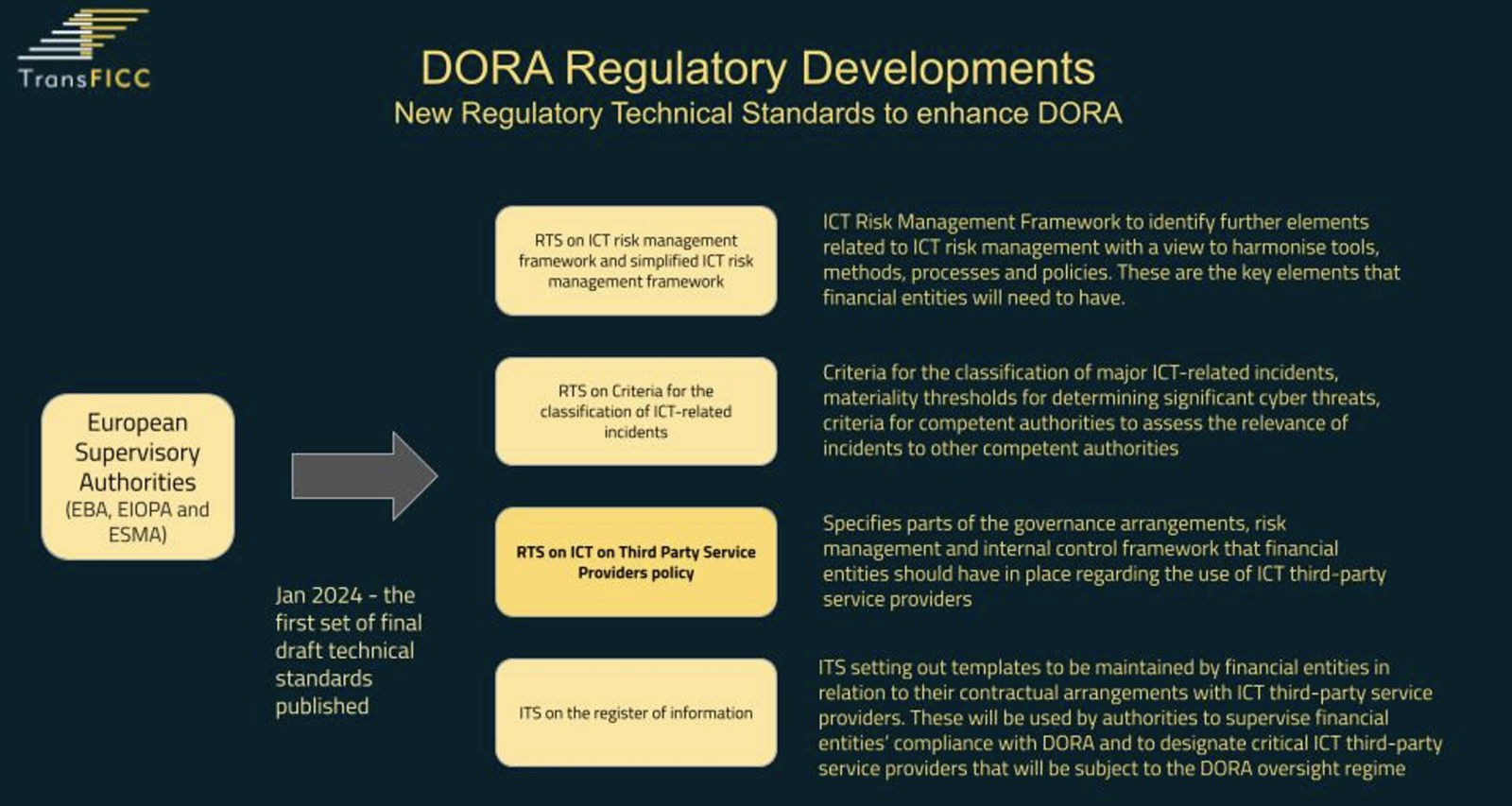

January 2024 saw the release of the first set of rules under DORA (The Digital Operational Resilience Act) for Information and Communication Technology (ICT). This blog explains its wide-ranging implications.

Steve spoke at the Innovate Finance Global Summit 2023, about innovation, digital transformation and FinTech partnerships.

We are honoured to win the Risk award for 'Electronic Trading Support Product of the Year'

For the second consecutive year TransFICC has been recognised as one of the best workplaces for technologists

As long-time fans of Dave Farley and his Continuous Delivery YouTube channel TransFICC is now an official channel sponsor

Now in its 5th year, the Financial Technologist showcases leading Capital Markets FinTechs

Press Release - TransFICC has announced a new initiative to develop a Consolidated Tape (CT) for Fixed Income. As part of this initiative, TransFICC has developed a production ready pilot, for Banks, Asset Managers and Regulators to test.

TransFICC has opened a New York office and hired Sean Murphy, Bo-Yun Liu and Khagay Nagdimov.

We were delighted to be win 'Trading Initiative of the Year' at the Financial News Excellence in Trading & Tech Awards 2023

Steve speaks with The Desk about all things tech - managing fragmentation, automating workflows, the need for speed, scalability on demand, modular tech and what's next in the evolution of the market.

TransFICC has closed a Series A extension for $17 million. Led by AlbionVC, all existing institutional shareholders took part in this investment round, which follows the original Series A for $7.8 million, announced in April 2020.

Now in its 5th year, the Financial Technologist showcases leading Capital Markets FinTechs

Press Release - TransFICC has announced a new initiative to develop a Consolidated Tape (CT) for Fixed Income. As part of this initiative, TransFICC has developed a production ready pilot, for Banks, Asset Managers and Regulators to test.

Steve speaks with Kiays Khalil from The TRADE News about the need for a Consolidated Tape in Fixed Income.

A smart application of hardware, cloud and open source technology makes for efficient trading systems and reduces the inefficiency that complexity creates

Like all companies, lockdown has impacted the way we work at TransFICC. We have always championed Extreme Programming as our methodology of choice, so when we decided to close the office at the start of March, this raised some issues around how we would operate with everyone working remotely.

Steve writes for The Financial Technologist - published by Harrington Starr

TransFICC has closed its Series A investment round for £5.75 million. Led by AlbionVC, it included new strategic investments from ING Ventures and HSBC. The new investors join existing shareholders, Citi, Illuminate Financial, Main Incubator (the R&D unit of Commerzbank Group) and The FinLab.