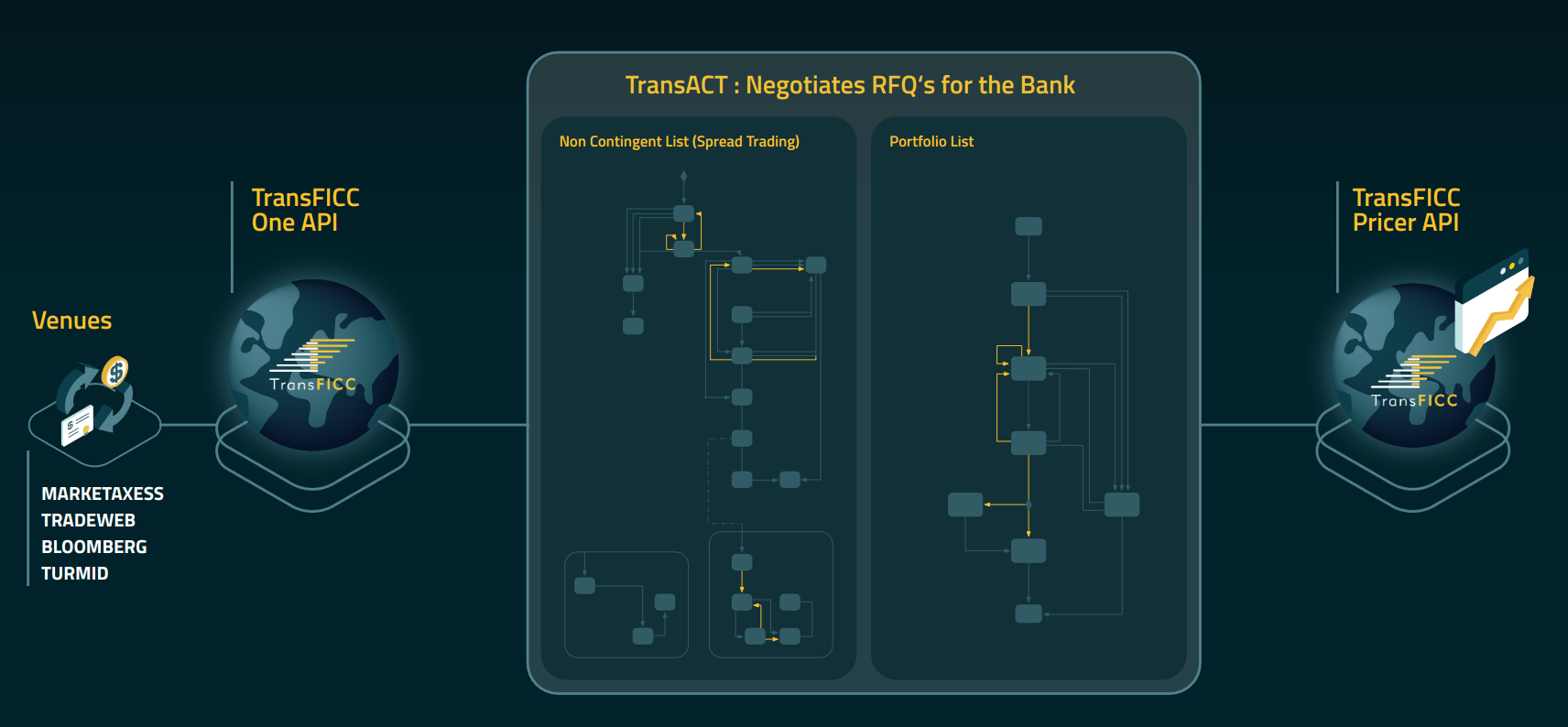

TransACT (Automated Customer Trading) - negotiates on the bank’s behalf

TransACT addresses the core challenge faced by dealers, where each trading venue API is different and support multiple complex trade workflows per asset class. TransACT provides one simple workflow for automation and is quick to deploy.

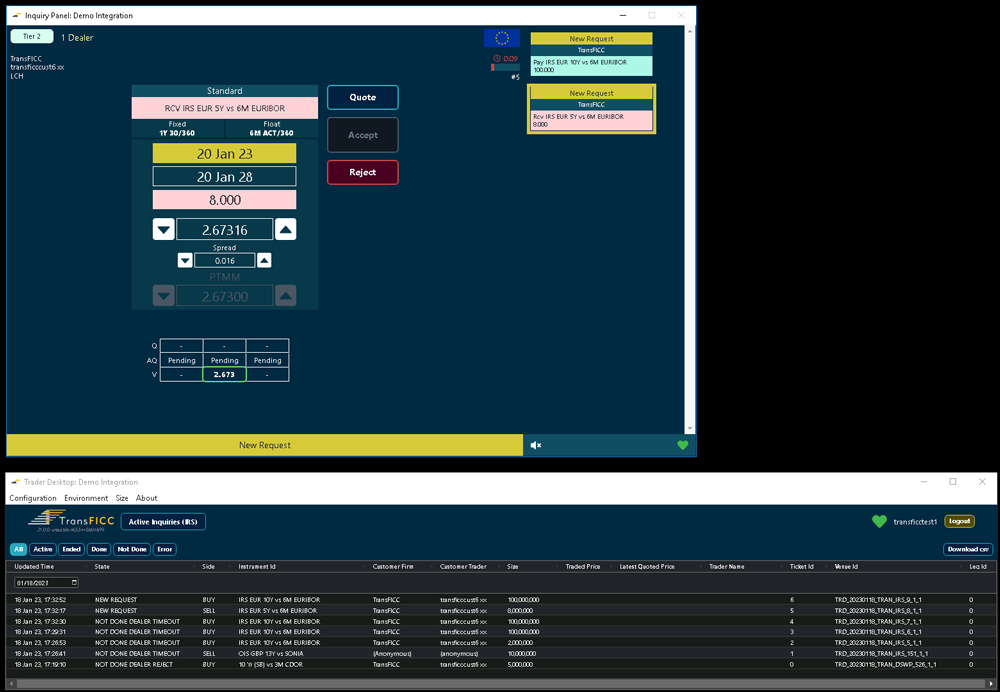

Outright Trading & Live/Historical RFQ Blotter - IRS

Multi-RFQ negotiation panel for live D2C trading with live and historical blotter view. Plug and play integration with external price source for live pricing and streaming.

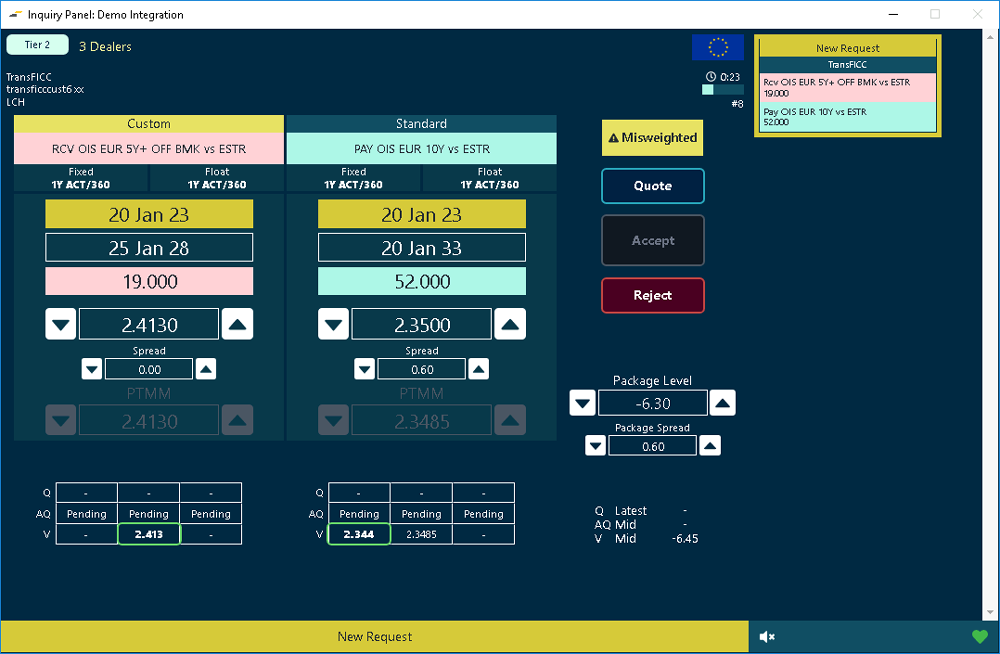

Multi-Leg Strategies - IRS

Handling of multi-legs strategies such as IRS curve trades. Package spread management integrated with live pricing.

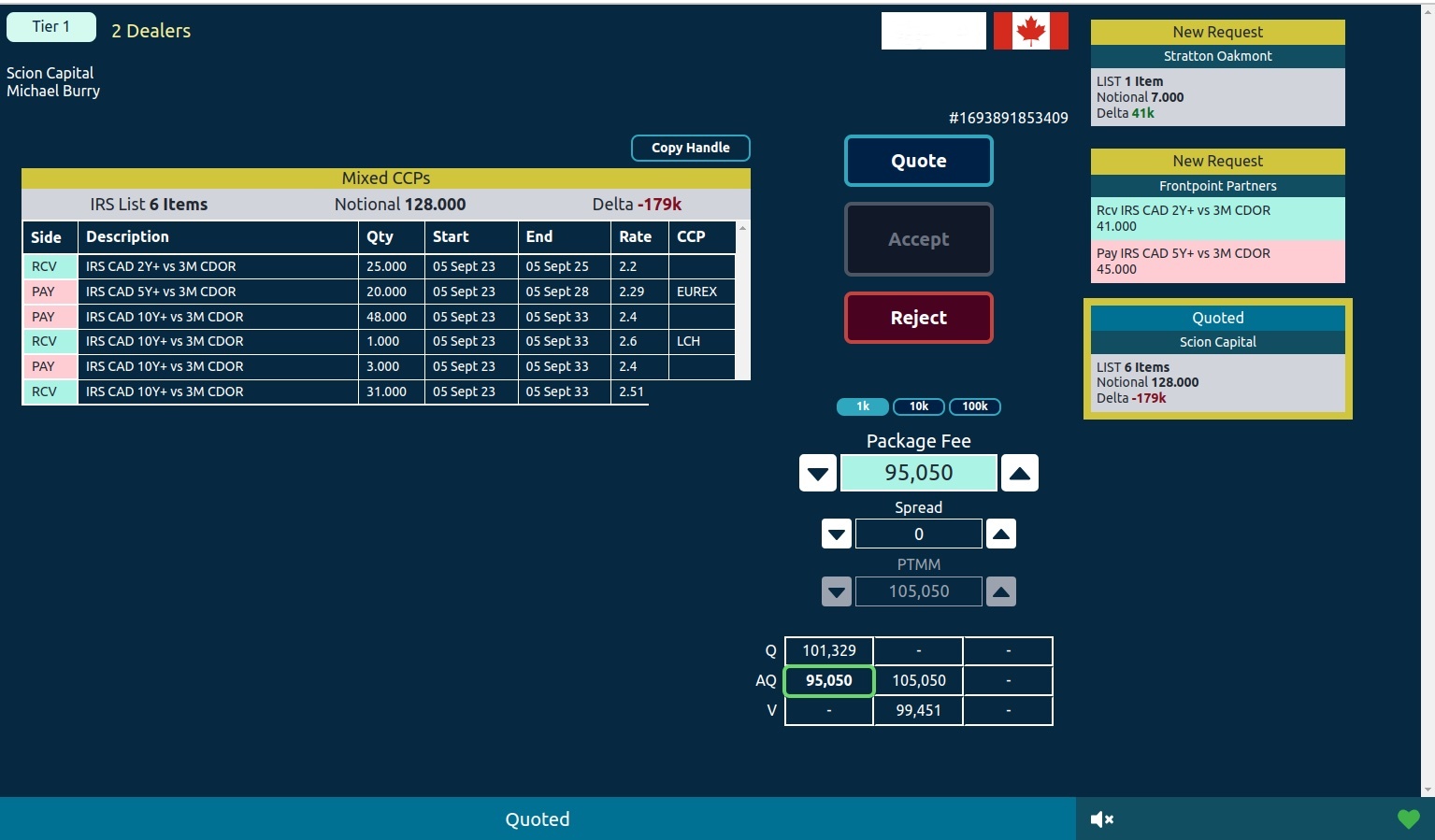

All-Or-None List Trading (Compression Trades) - IRS

Supporting AON list trading. Performant handling of a large number of items with support for basket Net Present Value negotiation.