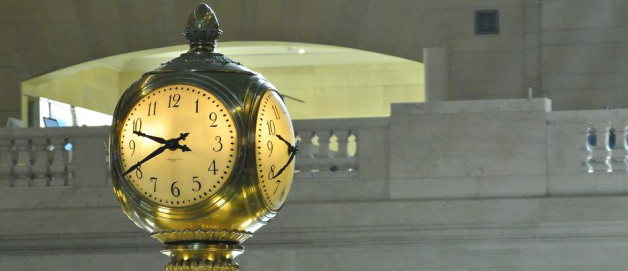

Time.....Where does it come from?

By Judd Gaddie

Time in a computing world

Computers make millions of decisions per second. In Financial Markets computers are used to automatically make decisions on whether to buy or sell assets. In order to determine the order of events we need clocks with micro and sometimes nano second granularity. A microsecond is one millionth of a second and a nanosecond is one billionth of a second.

To put that in perspective, one nanosecond is to one second as one second is to 31.71 years.

Markets in Financial Instruments Directive (MiFID)

MiFID is a large set of European Union laws which impose a broad range of regulations on investment services.

MiFID II requires details of trades to be published including the time at which they occurred. For traders using "high frequency algorithmic trading" it requires the clocks used have at least one microsecond granularity. See: Regulatory technical and implementing standards - Annex I , pg 507.

Granularity of a time measurement is not very useful if your measurement is not accurate. Ensuring time accuracy is much more challenging when you are attempting to sync clocks with microsecond accuracy.

For Judd's full blog post visit http://wireddevelopment.blogspot.com

Share