New Report - Corporate Bond Dealers Focus on Trade Automation

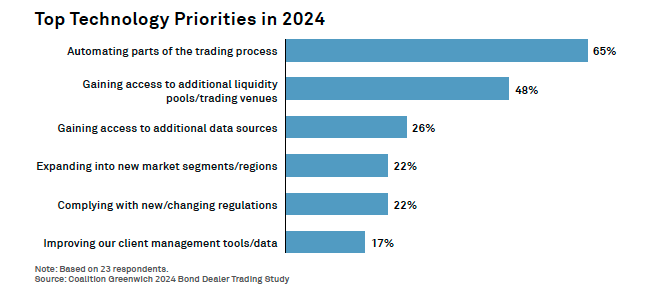

A new report from Coalition Greenwich highlights the increasing need for automation in the US corporate bond market.

An increasing number of client orders are now executed with little or no human intervention. While this approach to liquidity provision is currently dominated by the largest and most sophisticated firms, third-party technology providers are increasingly able to offer highly customisable auto-quoting and auto-ex solutions that allow dealers with fewer technological resources to step into the fray.

If you would like to see the full report please email [email protected]. This includes detail on auto-ex by type of bond, size and venue, OMS, pricing engine, rules engine and risk management.

A short excerpt is below -

The push toward automation

- Institutional investors are increasingly expecting near-instant liquidity when trading corporate bonds, with over 40% of the total notional volume of investment-grade (IG) bonds now traded electronically. The only way for dealers to meet this need is to price and quote bonds faster than a human could via point-and-click.

- While bond market volumes continue to rise, the market transparency is making it harder for dealers to capture profit margins. The same number of traders or fewer are handling an ever-increasing influx of client orders. Automation is the only way those traders can handle more clients and more orders while stillmaintaining the same level of service they always have.

This report is based on interviews with 26 U.S. corporate bond dealers, including top-tier global banks, nonbank market makers, middle market banks, and independent broker-dealers. This cross section of the market blends the bleeding edge with more traditional trading desks to present a picture of the sell side’s progress toward automation and where the opportunities lie going forward.

Email [email protected] to receive a copy of this report

Share