Weekly Roundup - Trends in Fixed Income Trading 2017 (Part 2)

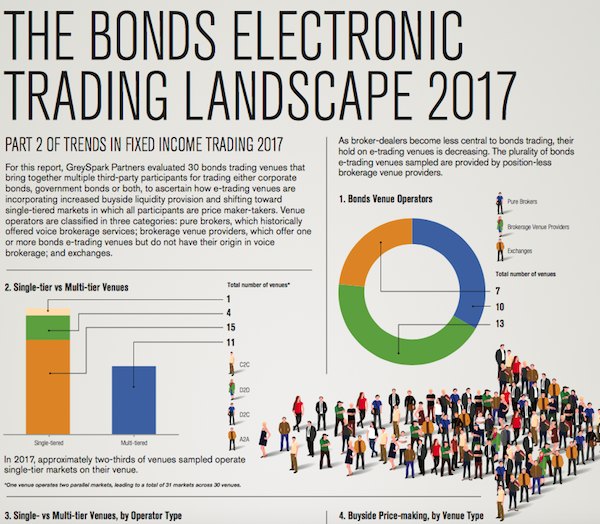

GreySpark's new report looks at how the Fixed Income market is evolving towards a single-tiered structure, where all participants are price maker-takers. It also profiles 15 non-bank bond trading venues and three fixed income liquidity aggregators / connectivity providers, including TransFICC.

In the report GreySpark states -

"Despite concerns over sufficient bonds markets liquidity and the limitations these concerns impose on finding counterparties, GreySpark analysis shows central limit order books (CLOBs) to be the most frequently offered matching methodology".

"The prevalence of CLOBs as well as a range of buyside-centric additional fixed income services on e-trading venues shows that the bonds market is shifting in the direction of single-tiered markets, in which all market participants have the same rights as price maker-takers, in place of the traditional multi-tiered markets."

A very interesting review of how the Fixed Income market is evolving in light of increased regulation and the emergence of new technology solutions.

For more information http://research.greyspark.com/2017/the-bonds-elect...

Share