Weekly Roundup - Trends in Fixed Income Trading 2017 (Part 2)

GreySpark has just published the second part of its Trends in FI Trading, which includes a review of TransFICC's recently launched One API for eTrading.

Read More

GreySpark has just published the second part of its Trends in FI Trading, which includes a review of TransFICC's recently launched One API for eTrading.

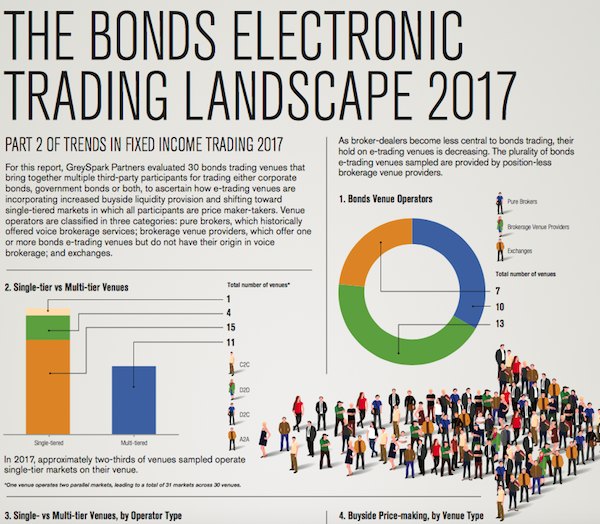

New report from GreySpark highlights the structural shift taking place in corporate and government bond trading.

FinTech is HOT in Asia - Steve and Tom have just returned from two exhausting days at the Echelon Asia Summit.

TransFICC has been selected to join The FinLab's accelerator programme. The FinLab is a joint venture between UOB and SGInnovate.

This week a piece in Markets Media stood out - mainly because it validates our business model. AxeTrading has received an investment of €2m, and Algomi and AllianceBernstein announced they will launch a bond market aggregator. This illustrates the demand for technology that helps navigate the fragmented bond market.

Views from last week's Fixed Income Leaders Summit in Boston. Two full days talking about the key themes in Fixed Income - Fragmentation, Regulation, Transparency and e-Trading.

A very interesting piece by Shanny Basar at Markets Media points to the expected growth of all-to-all corporate bond trading, the increasing number of venues offering all-to-all, how market data is exploding, and the role of technology in connecting these markets. It's got it all.

When markets were more manual and intermediated by people, the flow of information was limited to human networks. Electronic markets, coupled with increased market fragmentation, have multiplied the volume of market data exponentially.

Kevin Molloy and Sandy Woolard picked up the Best Infrastructure Provider Award (for the 2nd consecutive year)

Following Tradeweb’s purchase of Yieldbroker, TransFICC’s service was used to simplify connectivity and manage the migration to the new platform

TransFICC will bid to be the Consolidated Tape Provider (CTP) for the new UK and EU Consolidated Tapes. The FCA is expected to begin its tender process and criteria for the UK CTP in the next few weeks, and ESMA for the EU CTP in January 2025.

Having been shortlisted for two previous years, TransFICC has now been recognised at the "Top 1% Workplace Awards 2024"

Coalition Greenwich spoke with 26 bond dealers about the US corporate bond market. Sponsored by TransFICC, the report highlights key technology priorities for 2024

TransFICC has closed a Series A extension for $17 million. Led by AlbionVC, all existing institutional shareholders took part in this investment round, which follows the original Series A for $7.8 million, announced in April 2020.

Now in its 5th year, the Financial Technologist showcases leading Capital Markets FinTechs

Press Release - TransFICC has announced a new initiative to develop a Consolidated Tape (CT) for Fixed Income. As part of this initiative, TransFICC has developed a production ready pilot, for Banks, Asset Managers and Regulators to test.

Steve speaks with Kiays Khalil from The TRADE News about the need for a Consolidated Tape in Fixed Income.

A smart application of hardware, cloud and open source technology makes for efficient trading systems and reduces the inefficiency that complexity creates

Like all companies, lockdown has impacted the way we work at TransFICC. We have always championed Extreme Programming as our methodology of choice, so when we decided to close the office at the start of March, this raised some issues around how we would operate with everyone working remotely.

Steve writes for The Financial Technologist - published by Harrington Starr

TransFICC has closed its Series A investment round for £5.75 million. Led by AlbionVC, it included new strategic investments from ING Ventures and HSBC. The new investors join existing shareholders, Citi, Illuminate Financial, Main Incubator (the R&D unit of Commerzbank Group) and The FinLab.